Trust in the Age of Finfluencers: How Financial Brands Must Adapt

Posted by: Tom Hemingway - 29.04.25

In finance, trust has always been the foundation of customer relationships. But as we move further into 2025, the mechanics of building that trust have fundamentally changed. Traditional financial institutions now face a critical challenge: adapting to a world where trust is built through community engagement rather than polished corporate messaging.

A new financial services report from Ride Shotgun shows how financial buyers no longer make decisions based solely on slick marketing campaigns. Instead, they’re turning to their networks, professional forums, peer groups, Slack communities, and LinkedIn threads to validate financial decisions before making them. This shift requires financial providers to meet buyers where they actually are, with personalised experiences that demonstrate a deep understanding of their context and values.

The B2B sector has historically seen influencer marketing as a consumer-focused strategy, often resulting in slower adoption and missed opportunities for business impact. However, this overlooks the fundamental principle that makes influencer marketing effective: the trusted validation that occurs when experiences are shared within like-minded communities.

Recent data from McKinsey reveals that more than 50% of customers would switch providers if they don’t receive personalised service. This statistic alone should serve as a call to action for any financial institution still relying on a traditional, one-size-fits-all approach.

The Finfluencer revolution

The rise of financial influencers, or ‘finfluencers’, represents perhaps the most visible shift of this trust transformation. These digital finance personalities have built enormous followings by offering relatable financial advice that resonates particularly with younger demographics.

Prominent finfluencers like Humphrey Yang (54 million followers), Tori Dunlap (26 million followers), and Taylor Price (21 million followers) have become powerful voices in the financial conversation. Their combined reach exceeds what most financial institutions can achieve through traditional channels.

This shift in B2B influence has not gone unnoticed by regulators. The Financial Conduct Authority (FCA) last updated its guidelines on financial influencers in December 2024, following a comprehensive review of the rapidly growing finfluencer sector. The regulator reports that nearly two-thirds (62%) of 18 to 29-year-olds follow social media influencers, with 74% trusting their advice and 9 in 10 young followers report changing their financial behaviour based on influencer recommendations.

What does this mean for financial marketers?

For financial marketing leaders, this shift demands a rethink of engagement strategies. Trust is no longer built through blanket campaigns but earned through relevance, community participation, and alignment with customer values.

LinkedIn research into B2B technology buyers in the US, UK, and India found that short-form social video content from industry experts or influencers helps inform buying decisions for 63% of respondents.

The data points to three key areas where financial institutions must focus:

- Community engagement: Buyers are validating decisions within specialised peer groups and the most credible voices frequently exist outside your organisation.

- Personalised experiences: Generic messaging no longer lands effectively. Buyers expect interactions tailored specifically to their needs, context, and journey, and they expect this personalisation at scale.

- Transparent values: Environmental, Social and Governance (ESG) credentials and ethical positioning now significantly influence buyer trust. Brands must clearly communicate what they stand for consistently and authentically.

Top five tips for financial marketers

Cole Procter, Senior Account Director for HSBC at Ride Shotgun comments on the top five tips for financial marketers in 2025.

Think participation and promotion

“Whether operating in B2B, B2C, or B2B2C environments, remember that customers trust people, not campaigns alone. Identify communities aligned with your values and contribute meaningfully to the conversation. Real influence stems from shared knowledge rather than just advertising spend.

“According to GWI research, 36% of Gen X and Millennial consumers feel that “the feeling of taking part/being involved” helps them decide on brands they align with. This participatory approach represents a fundamental shift from traditional financial promotional strategies.”

Champion real advocacy

“Let your customers speak for you. McKinsey’s 2024 research shows that peer-to-peer advocacy is five times more impactful than brand marketing for complex financial services. This means moving beyond carefully curated testimonials to create space for honest, ongoing dialogue.

“B2B financial influencers like Humphrey Yang have emerged as particularly powerful voices, with their credibility capable of amplifying your message in powerful ways.”

Personalisation at scale

“Tailoring communication to real customer needs requires combining AI capabilities with account-based marketing (ABM) approaches. This enables a shift from reactive to proactive engagement. The most trusted financial brands now feel intuitive because they appear at precisely the right moment with relevant content.

“Accenture reports that 68% of financial institutions are planning significant investments in predictive personalisation in 2025 – a clear indication of the industry’s direction.”

Create seamless cross-channel experiences

“According to Gartner’s 2024 research, buyers are 2.8x more likely to act when their experience feels joined-up across channels. This requires breaking down organisational silos and ensuring digital, human, and automated touchpoints to tell a consistent story.

“Marketing leaders must rethink team structures and invest in new data and content capabilities to deliver personalisation at scale. Without this integration, even the best individual channel strategies will fall short.”

Design for confidence, not just convenience

“While good user experience builds baseline trust, financial customers need more, they must feel safe at every step. This means implementing clear data policies, transparent terms, and reassuring language.

“It also extends to designing interfaces that signal security, including features that exist primarily to provide comfort rather than functionality. Customer confidence stems not just from what your platform does, but how it makes people feel.”

The finfluencer opportunity

As we navigate through 2025, the rise of finfluencers isn’t a passing trend but a major shift in how financial decisions are made and trust is established for the new generation of financial buyers.

Gen Z buyers engage with B2B influencer content more than any other generation. Among those aware of influencer marketing, 90% say they engage with B2B influencer content monthly—11% more than older generations. This signals a clear shift: as more Gen Z buyers enter decision-making roles, influencer content will become even more central to effective marketing and communication strategies.

Several forward-thinking institutions have already recognised this opportunity. Amex, for example, built ‘Business Class’ a content and community platform tailored to small business owners, while Bank of America has invested in employee influencer programmes, turning internal experts into trusted thought leaders. These are great examples of how traditional finance can successfully integrate community-influencer led approaches.

For forward-thinking financial brands, this represents an opportunity to build deeper, more meaningful relationships with buyers and customers through community engagement, personalisation, and transparent values. By embracing this community-driven model, financial brands can create lasting connections with the next generation of buyers and customers.

Download the full financial services trend report from Ride Shotgun for more case studies, tips and trends across the financial sector.

Get Inspired

Today, strategic influencer partnerships have become crucial in how businesses evaluate and implement information. Yet many brands fail to develop the authentic, substantive relationships with finfluencers that their audience expects. Those organisations that understand and invest in genuine partnerships can effectively dominate key industry conversations where reputational equity is built.

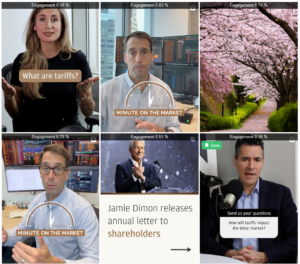

JP Morgan

Minute on the market

JP Morgan’s “Minute on the Market” initiative transforms complex financial data into accessible insights through brief, expert-driven content. This innovative approach positions their analysts as trusted voices in the financial space while delivering valuable market intelligence in formats designed for today’s time-constrained decision-makers.

BANK OF AMERICA

Employee Influencer Programmes

Bank of America has invested in employee influencer programmes — turning internal experts into thought leaders through LinkedIn content strategy support and subject matter visibility coaching. It’s part of their broader push toward humanising the brand across high-trust spaces.

BMO

Finfluencer Tracker

BMO has leaned into the finfluencer space by sponsoring financial wellness content and tools via YouTube and TikTok creators, targeting Gen Z and younger millennial audiences, especially in North America.

Download the full financial services trend report from Ride Shotgun for more case studies, tips and trends across the financial sector.

Ready to raise your content game? Let’s make it happen!

Get in touch